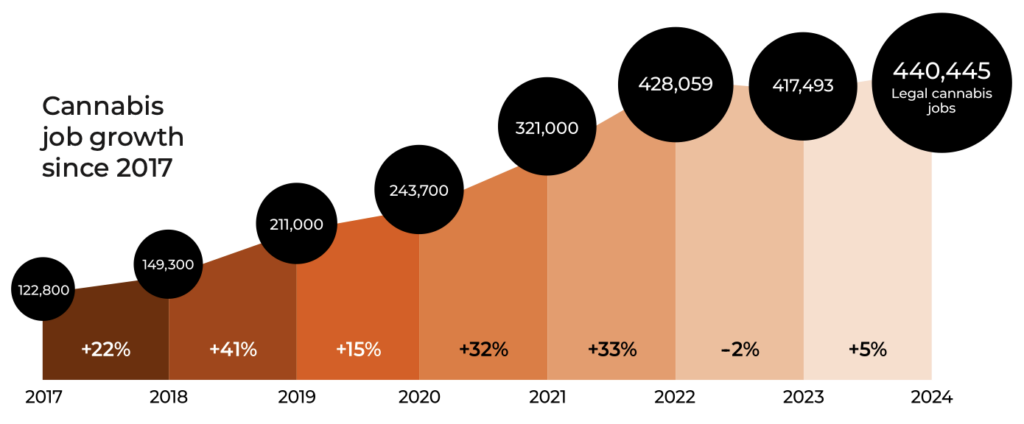

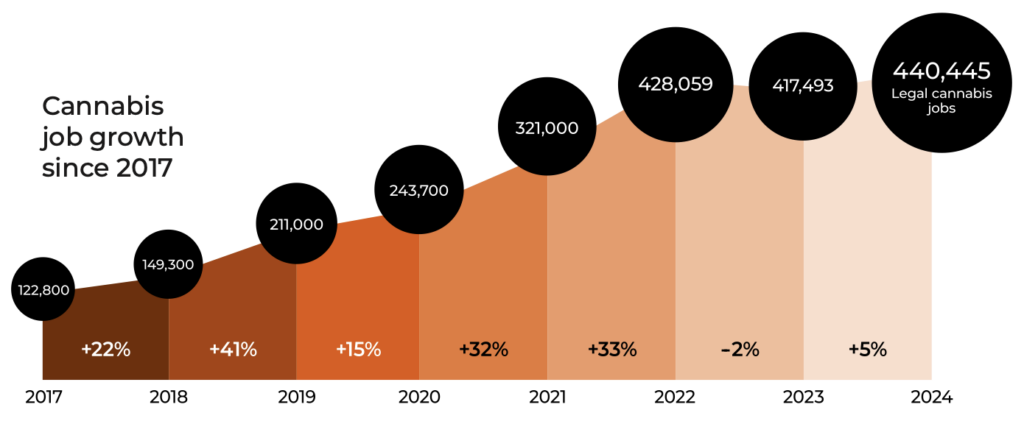

The number of full-time marijuana jobs in the U.S. rose by nearly 5 percent during the past year, according to the latest annual industry report on employment in the cannabis sector. That’s a turnaround from the roughly 2 percent decline between 2022 and 2023, but otherwise it marks the slowest year-over-year growth going back to 2017.

All told, legal cannabis in the nation supports more than 440,000 full-time equivalent jobs, says the new report from Colorado-based marijuana staffing company Vangst and the analytics firm Whitney Economics.

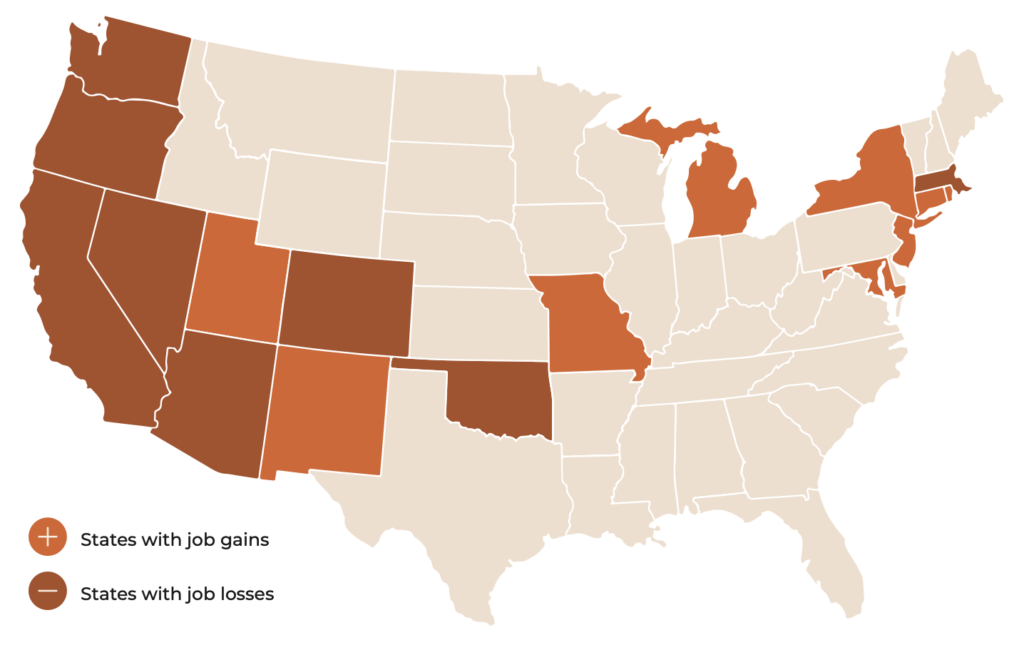

Despite the overall rise in cannabis-related jobs, the report notes that the year’s job growth “wasn’t spread evenly” across the country. “Now more than ever,” it says, “America’s cannabis industry is a state-by-state, region-by-region job market.”

In Michigan, for example, where marijuana sales have surged in the past few years, the industry saw growth of more than 11,000 jobs, the report found—39 percent growth from a year earlier. Missouri’s first full year since the state’s launch of its adult-use market, meanwhile, added 10,735 jobs.

Other states that saw job growth included New Jersey, Maryland, Connecticut, New York, New Mexico, Rhode Island and Utah.

Vangst Jobs Report 2024

In more established state cannabis markets, however, trends pointed the other direction. Colorado and Washington—the first two U.S. states to legalize marijuana and open retail stores to adults—saw 16 percent and 15 percent job losses, respectively.

California’s massive marijuana market, for its part, supports 78,618 jobs as of March 2024, the report found—but that’s down 6 percent from a year earlier.

“A countervailing pushback in mature markets in the American West (California, Colorado, Oregon, Washington, and Nevada) resulted in the loss of roughly 15,000 jobs across the region,” the report says, also noting that Oklahoma, Nevada, Massachusetts and Arizona recorded losses.

Authors of the Vangst report attribute the shrinkage to a variety of factors, including an oversupply of cannabis and a dip in marijuana-related tourism. “The expansion of adult-use sales to 20 states,” the report notes, for example, “has reduced Colorado’s cannatourism to a fraction of its former self.”

“The experience of buying legal weed in a retail store may also have lost some of its novelty,” the report notes, pointing to Las Vegas and its annual 40 million visitors. “Nevada’s 2023 annual revenue came up $50 million short of the $880 [million] mark set in 2022, and roughly 1,000 jobs crapped out.”

The industry report is nevertheless optimistic, projecting a turnaround in the next couple years.

“We expect losses in these markets to continue to thin out in 2024 and turn positive once again in 2025,” authors wrote.

Vangst Jobs Report 2024

While the report does not project jobs numbers into the future, it includes a forecast of nationwide cannabis revenue looking ahead to 2035—at which point it expects the U.S. marijuana market to be making $87 billion. That’s more than triple the $28.8 billion in revenue the industry made in 2023, according to Vangst.

In addition to job numbers, the new report also touches on what various positions within the cannabis industry are paid. Trimming marijuana, for example, pays between $14 and $27 an hour, while a director of cultivation makes between $90,000 and $140,000 annually. On the retail side, typical budtenders make between $14 and $22 an hour, while retail directors make between $80,000 and $120,000 per year.

Together, retail and cultivation categories make up more than half (54 percent) of all marijuana industry jobs.

Karson Humiston, Vangst’s founder and CEO, noted in a press release that the company’s tracking of marijuana jobs per state is “something that the federal government does not do for our industry.”

While the federal government does not track cannabis jobs numbers, the U.S. Census Bureau last year began collecting data on marijuana business activity as well as state cannabis tax revenue.

Last September, before launching the interactive map, the agency published a report showing that legal cannabis states had collected more than $5.7 billion in marijuana tax revenue over an 18-month period. It also recently updated its survey of private businesses to better capture marijuana-related economic activity.

This is the second year that Vangst has produced the cannabis jobs report. Previously it had been commissioned by the marijuana advertising platform Leafly. It’s the product of cannabis economist Beau Whitney and writer Bruce Barcott.

The findings generally follow state marijuana revenue trends, which also vary greatly from one jurisdiction to another. A number of states saw record-setting sales to close out 2023. Many of those states were relatively new markets, which tend to grow comparatively quickly.

In nearly all states, meanwhile, rising adult-use cannabis sales have coincided with falling sales of medical marijuana, as some patients turn to recreational retailers out of convenience, due to product price or selection or to avoid state registration.

Though some states have seen sales numbers flatten or fall over time, the marijuana market across the United States as a whole is expected to continue to scale up as more states come online. The multinational investment firm TD Cowen projected late last year that legal cannabis sales will reach $37 billion in 2027, up from what it said was about $29 billion in 2023. At least some of that growth is expected to come from increased substitution of cannabis for alcohol, particularly among younger adults.

One aspect of the cannabis jobs market that the Vangst report does not touch on is the possible impact of unionization on the industry. A push by workers in Missouri, for example, has raised the legal question of whether or not marijuana trimmers and others are considered agricultural workers and whether they have the right to organize.

The post The Legal Marijuana Industry Now Supports More Than 440,000 Full-Time Jobs, Up 5% From Last Year, Report Finds appeared first on Marijuana Moment.