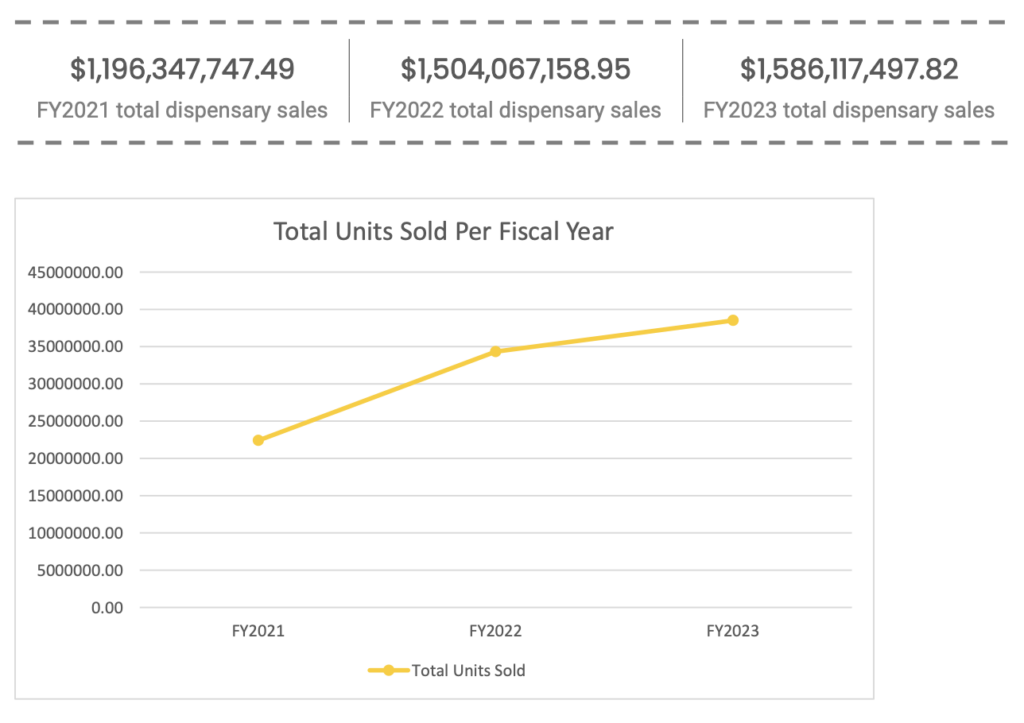

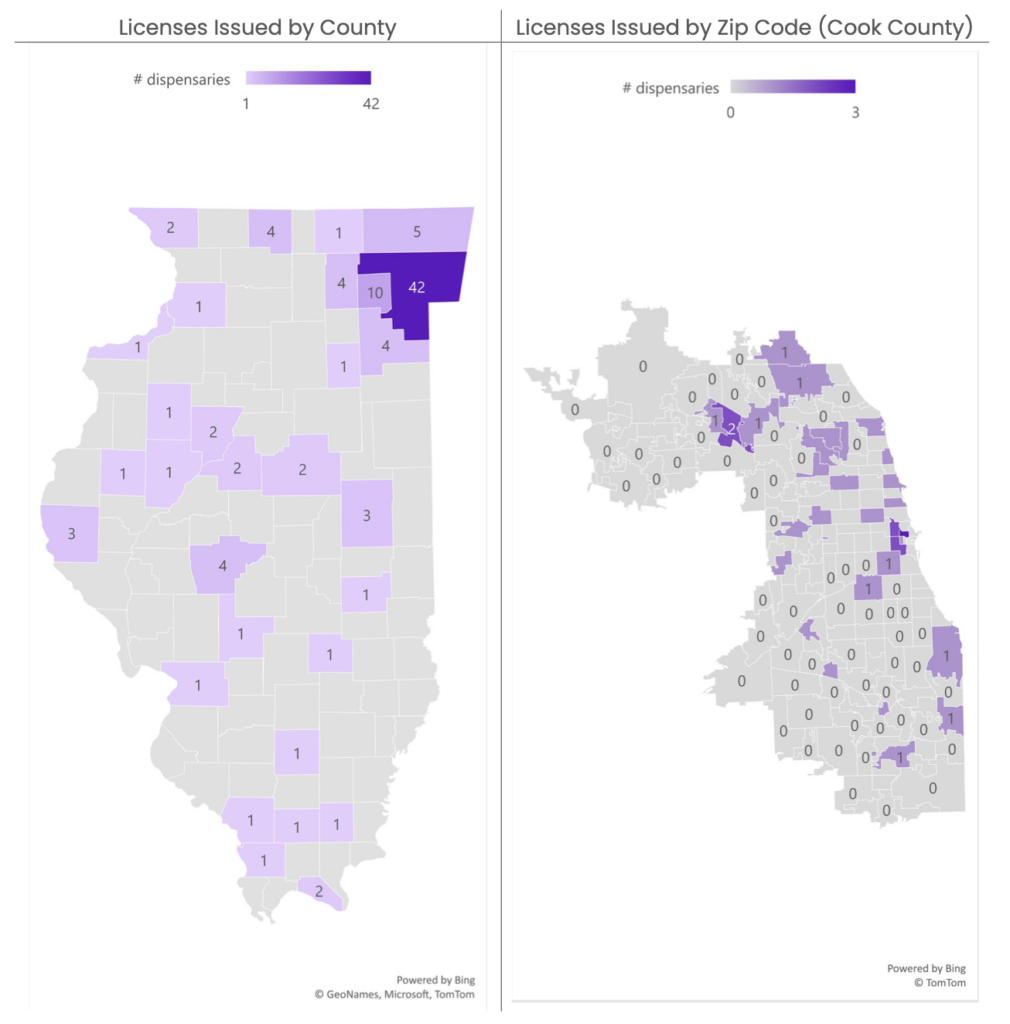

Legal marijuana in Illinois saw “unprecedented growth” in fiscal year 2023, says a new annual report from the state’s Department of Financial and Professional Regulation (IDFPR), with the opening of 28 new retailers and more than $1.5 billion in total retail sales.

Total tax revenue from the industry dropped in fiscal year 2023, however, falling to $420.9 million from a record $435.1 the previous year.

All told, the legal cannabis industry brought in about $451.9 million for the state in fiscal year 2023, which ran from July 1, 2022 to June 30, 2023, according to separate numbers from the Department of Revenue. As in past years, Illinois made significantly more revenue from cannabis than from alcohol, which brought in about $316.3 million during the same period.

“Fiscal Year 2023 saw unprecedented growth in the cannabis market not seen since the start of the medical program in 2015 and adult use cannabis was legalized in 2020,” the new report says. “Looking towards the future and Fiscal Year 2024, IDFPR anticipates continued growth of the regulated market.”

Illinois Department of Financial and Professional Regulation

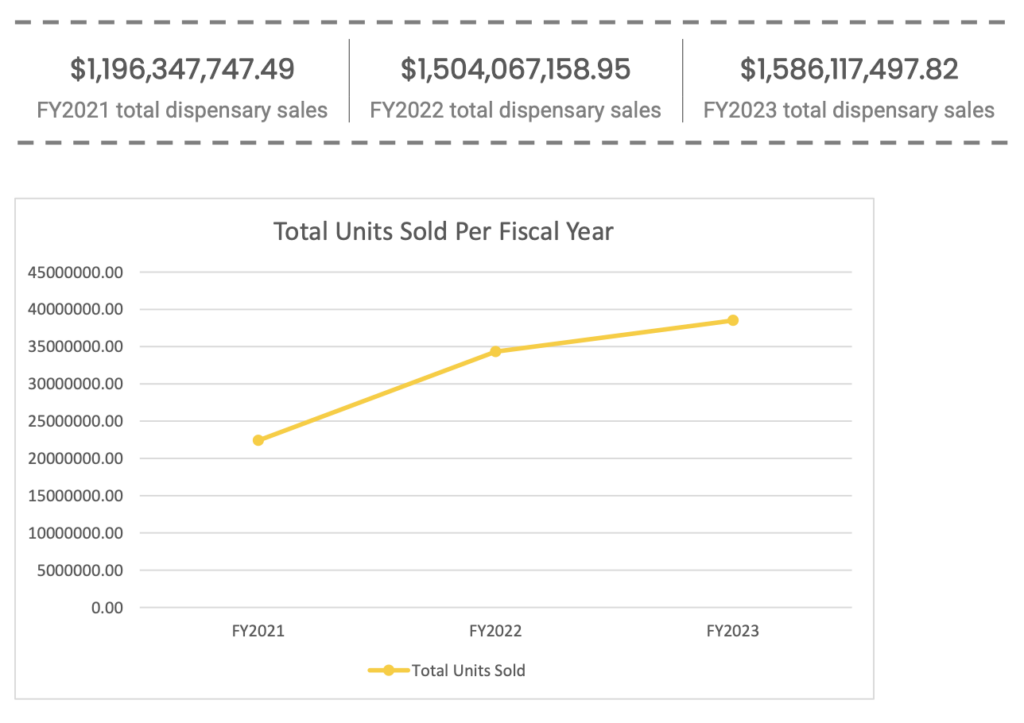

Over the entire fiscal year, 200 conditional licenses were issued. In December 2022, the department also finalized rules for a new Social Equity Criteria Lottery, aimed at prioritizing people who have been disproportionately impacted by the war on drugs. More than 2,600 individuals applied for 55 new social equity dispensary licenses.

The vast majority of newly issued licenses were in Cook County, the state’s most populous.

Illinois Department of Financial and Professional Regulation

Twenty-eight new retailers opened across the state during the fiscal year, which the agency said represent “ownership groups that are not connected to the existing medical cannabis and same site dispensaries.”

Last year’s report noted a striking lack of diversity in Illinios’s legal cannabis industry, with white people making up 88 percent of majority owners and 80 percent of C-suite executives. While the new 2023 report does not include the same demographics breakdown, it boasts “increased diversity at all levels of dispensary ownership, employment, and products offered.”

All 28 of the newly opened retailers, the state says, were majority owned by veterans. Five of those licenses are also majority owned by women, and 15 are majority owned by people of color, according to voluntary self-reporting.

“With this new group of dispensaries,” the IDFPR report says, “over 50% are majority owned by people of color and almost 20% are majority owned by women.”

While social equity retailers “have only been open a fraction of the year, with the first two licenses being issued on November 10, 2022,” it adds, “they still had $57,647,366.56 in sales during FY2023.”

Among employees, 26 percent identified as people of color, 48 percent identified as women or nonbinary, and 9 percent of employees identified as disabled, according to IDFPR, which cited an ongoing state diversity survey launched by the Cannabis Regulation Oversight Officer in May.

The total number of marijuana products sold in fiscal year 2023 also rose, climbing to nearly 45 million, the report says. Most product categories saw growth, with the only exceptions being infused liquids and infused topicals.

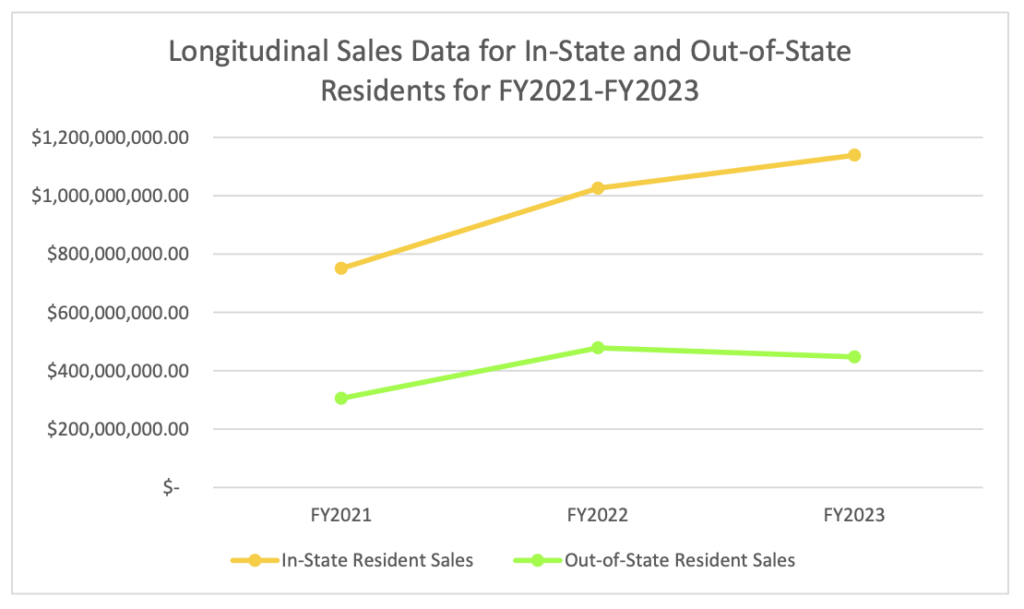

About a quarter of all cannabis sales went to out-of-state residents. “This is only one piece of the market rather than something the industry must depend on,” the report says.

Illinois Department of Financial and Professional Regulation

For fiscal year 2024, IDFPR said, it aims to issue 55 social equity licenses, hire and onboard eight new inspectors and processors “to decrease the time to license individuals and businesses” and increase public outreach. The agency also intends to implement a new seed-to-sale tracking program, the report says.

“IDFPR stands ready to continue issuing dispensary licenses and is committed to promoting social equity, safety, and growth into the regulated cannabis market,” it said.

By law, DOR is required to include in its annual report any recommendations for changing the state tax rate on adult-use cannabis, but it elected not to do so. “At this point in time, the Department believes the program is still too young to make meaningful tax rate recommendations,” the report says.

Illinois taxes any cannabis product at a rate of 20 percent of the purchase price, with tax rates increasing by product potency. Effective rates can exceed 40 percent if local governments tack on an additional 3 percent tax.

The current fiscal year got off to a busy start, according to recently released state sales data showing that retailers sold a record $140 million worth of adult-use cannabis products in August. In September, the state set a record for the number of individual products sold on the adult-use market, though total receipts were slightly lower, at $139.5 million.

Gov. J.B. Pritzker (D) pointed to the industry growth and strong sales numbers last month, downplaying the state’s comparatively steep retail prices. According an analysis by the Illinois Policy Institute, Illinois is the third-largest retail marijuana market after Michigan and California.

“We still have a growing industry, as you know, it is one that I initiated in 2019 that has brought in almost $450 million to state and local governments,” Pritzker told The Center Square. “We want to encourage all industries to grow.”

Pritzker, who supported legalization in the state, also recently signed a bill allowing licensed marijuana businesses to claim state tax deductions as a partial fix to Internal Revenue Service (IRS) tax code 280E.

Photo courtesy of Philip Steffan.

The post Illinois Officials Highlight ‘Unprecedented Growth’ Of Legal Marijuana Market As Cannabis Revenue Outpaces Alcohol appeared first on Marijuana Moment.