New York City could eventually see marijuana sales reach up to $1.2 billion annually, resulting in about $47 million in local tax revenue, a new report from a government-funded independent economic agency found. But the question is, how long will it take?

With an abundance of unlicensed retailers still operating in the city and lawsuits hamstringing regulators’ ability to expand the legal market, certain factors will need to change in order for New York’s cannabis industry to reach its full economic potential, the New York City Independent Budget Office (IBO) says.

There are different projections for what can be expected over the next few years, but the city Office of Management & Budget (OMB) estimates that, by the 2027 fiscal year, the market will be producing $38 million in marijuana tax revenue annually, which translates into about $950 million in sales.

That’s possible, IBO said, but only if the city doubles the rate of retailer openings. At the current rate, one shop is opening each month, or 12 on average in a year. At the current pace, those dispensaries are selling about $8.1 million worth of marijuana on an annualized basis, the report says. If that trend persists, it would take the city until October 2032 before it would see the $950 million in annual sales.

High expectations: if it can overcome initial growing pains, the NYC legal #cannabis market could bring in $1.2 Billion in taxable tales and $47 Million in annual revenue for the city. Read more! https://t.co/EC9d06uw65 pic.twitter.com/vo1k7cTIYh

— New York City Independent Budget Office (@nycibo) August 24, 2023

But if the city starts opening 24 shops per year, and they all continue to make about $8 million in taxable sales annually, then it would be on pace to reach OMB’s projection of $950 million by 2027. The report also contemplates a scenario where 24 shops open each year, but average annual purchases are lower, at $6 million. In that case, the state would hit the $950 million estimate by July 2029.

“It is exciting to contemplate a new source of revenue from legal cannabis sales, but it’s also important to take a realistic look at when and whether NY can count on this fiscal boost,” IBO Director Louisa Chafee said in a press release on Thursday. “This analysis looks at the rapidly changing environment and provides revenue scenarios that may be seen depending on the pace of the continued rollout of the legal market.”

Director Louisa Chafee: It is exciting to contemplate a new source of revenue from legal cannabis sales, but it’s also important to take a realistic look at when and whether New York can count on this fiscal boost. IBO's report https://t.co/EC9d06uw65 pic.twitter.com/m7eKm7bGj3

— New York City Independent Budget Office (@nycibo) August 24, 2023

Licensed retailers might be better positioned to see higher sales if the city manages to effectively mitigate the presence of illicit shops, as lawmakers and regulators are working to do. IBO analyzed law enforcement data about the value of unregulated marijuana that they’ve seized from certain illicit storefronts and estimated that the approximately 1,500 unregulated shops in the city have a stock of products valued as much as $484 million.

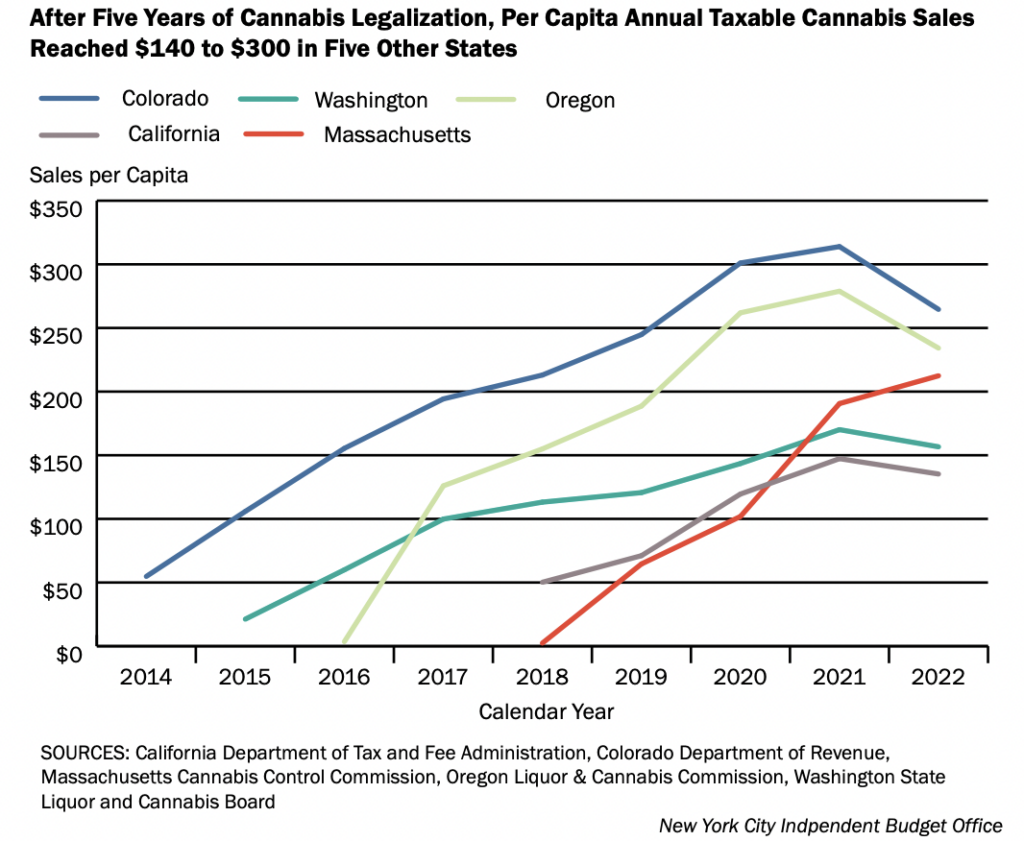

The report separately looked at cannabis sales trends in five of the most well-established state markets—California, Colorado, Massachusetts, Oregon and Washington State—and determined that, overall, “New York City may eventually see annual taxable sales between $833.6 million and $1.2 billion.”

“A market of this scale would yield between $33 million to $47 million in annual city revenue,” it said. “However, New York State’s unique requirements for retail licenses have resulted in a slower rollout of the legal market.”

Those requirements include prioritizing licensing for social equity applicants that have been disproportionately harmed under prohibition—one of the features of the state’s legalization law that has prompted lawsuits delaying the rollout.

If the per capita marijuana sales rate in New York City reached Colorado’s 2021 levels, the tax revenue could go up to $105 million annually. However, until the market “develops further over the coming months and years, it will be impossible to predict accurately the size to which New York City’s legal cannabis market will grow.”

The analysts also pointed out that the five early-adopter states “each enjoyed additional revenue from having a first-mover advantage.”

“Out-of-state visitors who could not purchase cannabis in their own states presumably visited early legal cannabis markets, increasing retail sales in those markets. Because all of New York’s regional neighbors besides Pennsylvania have legal retail cannabis markets, New York is unlikely to benefit from similar circumstances,” it says. “Another important difference between states that may affect legal market growth is New York’s unique focus on awarding early retail licenses to justice-involved individuals and other social equity applicants.”

“Ultimately, the direction and pace of the legal cannabis market rollout in New York City will depend on several factors: the speed of dispensary openings, the scale of annual sales of cannabis at each dispensary, the rate at which consumers choose licensed dispensaries over unlicensed smoke shops, and the impact of legal actions on the nascent cannabis market,” the report concludes. “IBO’s analysis indicates that the city’s and state’s revenue projections are potentially within reach, especially if the rate of new licensed dispensary openings increases.”

—

Marijuana Moment is tracking more than 1,000 cannabis, psychedelics and drug policy bills in state legislatures and Congress this year. Patreon supporters pledging at least $25/month get access to our interactive maps, charts and hearing calendar so they don’t miss any developments.

![]()

Learn more about our marijuana bill tracker and become a supporter on Patreon to get access.

—

Meanwhile, to help address supply and demand issues resulting from the slow legalization rollout, New York regulators have approved the first cannabis farmers markets where growers and retailers can partner to sell their products to adults at open-air events in municipalities that allow it.

Separately, New York City officials announced last month that they’re seeking lenders to support a marijuana equity fund that will promote participation in the industry by people who’ve been disproportionately impacted by criminalization.

Gov. Kathy Hochul’s (D) administration is also stepping up its push to transition people to the legal market, despite the bottlenecking of getting approved retailer licensees launched so far.

That included launching a public education campaign in April encouraging adults to buy their marijuana from licensed shops to ensure that products are safe and that revenue is used to advance equity and reinvestment goals.

The New York Senate has also formed a committee focused exclusively on marijuana that will be collaborating with regulators as the state’s cannabis market evolves.

Officials did announce in March that they were doubling the number of conditional adult-use marijuana licenses that can be approved, from 150 to 300, after receiving feedback from certain applicants that they would be able to more expeditiously open storefronts without additional support through a state program designed to help eligible entities create physical locations.

The post NYC Could See $1.2 Billion In Marijuana Sales Annually, But Licensing Hiccups And Unregulated Market Are Holding It Back, City Economists Say appeared first on Marijuana Moment.